Understanding Alternative Data in Trading

What is Alternative Data?

Trading strategies are evolving, and data is the driving force behind this transformation. While traditional financial metrics like earnings reports and stock charts remain valuable, they no longer offer the competitive edge traders need in fast-paced markets. Enter alternative data—a revolutionary approach to gathering insights.

By incorporating unconventional datasets like satellite imagery, social media sentiment, and geolocation data, traders can craft strategies that are more informed, predictive, and adaptive. These data sources provide real-time context to market conditions, helping algorithms identify trends and capitalize on opportunities long before traditional metrics reflect them.

In the world of algorithmic trading strategies, where speed and precision are paramount, alternative data has become the secret weapon for traders seeking a significant edge. This article explores how alternative data is reshaping trading strategies, diving into examples from satellite imagery to social media trends and beyond.

Why is Alternative Data Crucial for Algorithmic Trading?

In algorithmic trading, speed and precision are paramount. Algorithms thrive on data inputs, and the richer the data, the better the strategy. Alternative data bridges gaps left by traditional sources, offering:

- Faster insights into consumer behaviors.

- Deeper understanding of supply chain dynamics.

- Edge in identifying trends before they materialize in the market.

For example, satellite imagery can reveal parking lot activity at major retailers, providing instant insights into sales performance before official reports.

Satellite Imagery: A Bird’s-Eye View of Market Trends

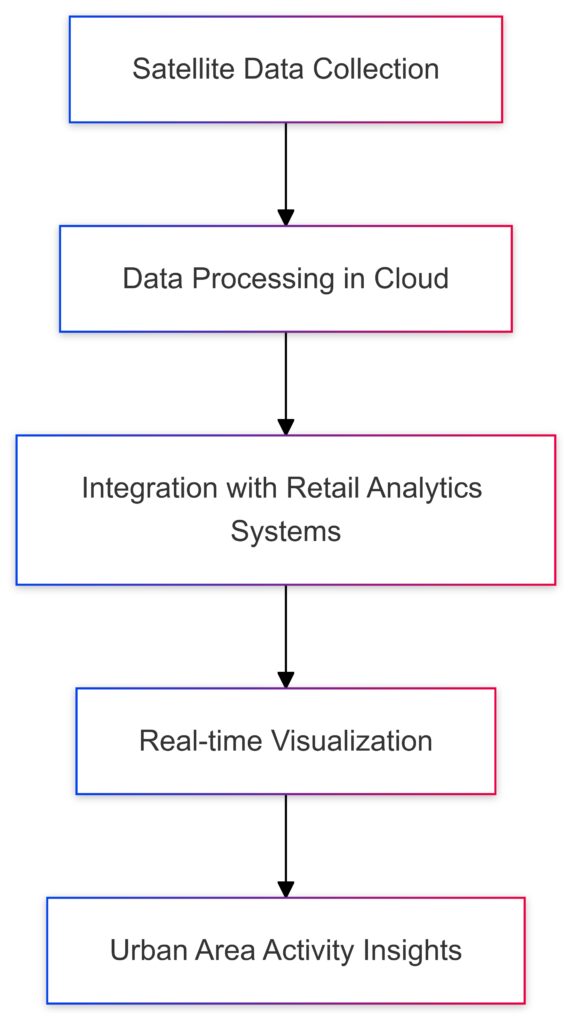

Visualizing retail parking lot occupancy using satellite imagery to forecast consumer activity patterns.

How Do Traders Use Satellite Data?

Satellite imagery tracks physical indicators of economic activity. Examples include:

- Crop yields observed via vegetation health indices.

- Port traffic to estimate global trade volumes.

- Retail foot traffic, captured from parking lot occupancy.

Hedge funds often use this data to adjust positions ahead of earnings announcements, minimizing the risk of relying on backward-looking reports.

Benefits and Challenges

This data offers unprecedented accuracy in real-world monitoring, but challenges exist:

- High costs for accessing and processing the data.

- The need for robust data-cleaning algorithms.

- Ethical concerns about privacy and surveillance.

Despite these hurdles, satellite imagery’s potential to shape trading decisions makes it a favorite in the alternative data toolkit.

Social Media Sentiment Analysis in Trading

Mining Social Media for Financial Sentiment

Platforms like Twitter and Reddit are goldmines of real-time sentiment. Algorithms use Natural Language Processing (NLP) to:

- Measure investor optimism or fear around a stock.

- Track trending tickers on forums like r/WallStreetBets.

- Identify breaking news before it hits traditional outlets.

This approach is especially effective during market-moving events, such as earnings calls or geopolitical crises.

The Rise of Retail Traders and Social Influence

The GameStop phenomenon of 2021 showed how retail traders, coordinated via Reddit, can significantly impact stock prices. Social media sentiment tools help professional traders anticipate such moves, turning potential chaos into calculated opportunity.

The Power of Geolocation Data

Tracking Consumer and Business Activity

Geolocation data from smartphones allows traders to observe:

- Foot traffic trends in retail stores, malls, or stadiums.

- Logistics activity, such as truck or fleet movements.

This data enables detailed forecasting of economic activity in real-time. For example, an increase in store visits might signal upcoming revenue growth for a retailer.

Privacy Concerns and Regulation

While geolocation data provides competitive advantages, regulators have raised concerns about consumer privacy. Compliance with data protection laws is critical to using this data ethically.

Web-Scraped Data and Online Trends

Using Web-Scraped Insights

Web scraping collects publicly available information from websites, forums, and online marketplaces. Key applications include:

- Tracking product prices on e-commerce platforms.

- Monitoring supply chain bottlenecks through reviews or forums.

- Analyzing corporate hiring trends via job posting activity.

This type of data empowers traders to predict macro and microeconomic trends, helping them fine-tune algorithms for maximum accuracy.

The Risks of Scraped Data

While it’s a valuable resource, web-scraped data carries legal and ethical risks, including:

- Violating terms of service agreements.

- Misinterpreting raw or biased information.

Nonetheless, with proper safeguards, web scraping remains indispensable for algorithmic traders looking for cutting-edge insights.

Predictive Analytics Powered by Alternative Data

The Role of Machine Learning in Alternative Data

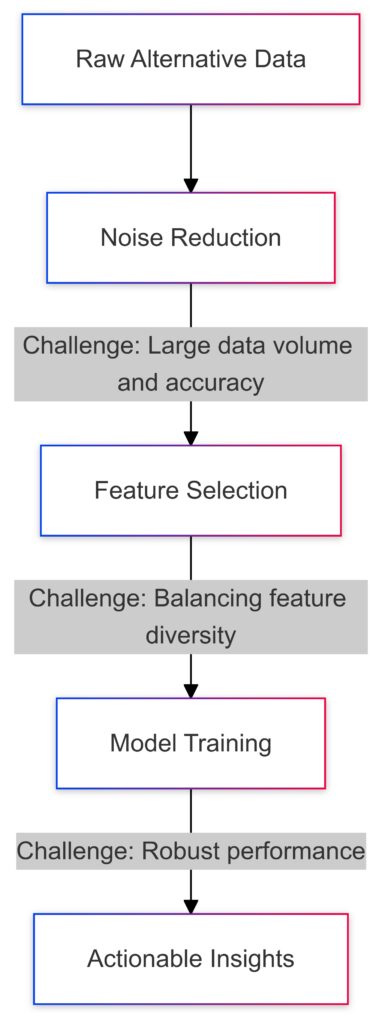

Machine learning (ML) transforms raw alternative data into actionable trading signals. Algorithms analyze diverse datasets, identifying patterns and correlations that human traders might miss. Key ML applications include:

- Predicting market volatility based on news sentiment.

- Identifying anomalies in trading behavior through data clustering.

- Improving portfolio optimization by integrating unique datasets.

For example, ML algorithms can detect seasonal purchasing habits from geolocation data, helping traders time their market entries and exits.

Overcoming Noise in Alternative Data

Alternative data often contains high levels of noise—irrelevant or misleading information. Machine learning excels at filtering out this noise by:

- Using data-cleaning techniques like outlier removal.

- Training models to focus on predictive variables while ignoring noise.

This ensures the trading strategies derived are reliable and efficient.

ESG Data in Algorithmic Trading

What is ESG Data?

Environmental, Social, and Governance (ESG) data evaluates a company’s sustainability practices and ethical performance. Examples include:

- Tracking carbon emissions from industrial facilities.

- Monitoring social initiatives through public disclosures.

- Analyzing board diversity statistics.

For traders, ESG data offers a fresh perspective on long-term risks and opportunities, especially as socially responsible investing (SRI) gains traction.

Incorporating ESG Data into Trading Models

Algorithmic trading strategies increasingly integrate ESG metrics to align with investor priorities. Benefits include:

- Identifying low-risk, high-growth stocks in clean energy sectors.

- Predicting reputational risks from environmental scandals.

- Aligning portfolios with sustainability trends, attracting ESG-focused investors.

This shift demonstrates the growing importance of ethical considerations in modern trading strategies.

News and Event Detection

Real-Time News Analytics

News events have an immediate impact on market dynamics, and algorithms powered by alternative data offer a competitive edge. Tools for news analytics include:

- Sentiment analysis of breaking news stories.

- Detection of keyword trends related to specific industries or companies.

- Monitoring geopolitical developments for macro-level insights.

For example, traders can anticipate supply chain disruptions by tracking news of natural disasters or trade embargoes.

Alternative Data vs. Traditional News Feeds

Unlike traditional news feeds, alternative data sources often provide early warning signals. Social media or web forums may highlight trends before official media outlets. Algorithms tuned to such sources can capitalize on pre-market opportunities.

Financial APIs and Crowdsourced Data

The Rise of Financial APIs

Financial APIs provide traders with access to structured alternative data from various providers. These tools simplify:

- Data aggregation, combining information from multiple sources.

- Customizable insights for specific trading models.

- Real-time updates on market-moving events.

APIs, such as those from Quandl or Alpha Vantage, integrate seamlessly with algorithmic systems, enabling faster decision-making.

Crowdsourced Insights from Retail Investors

Crowdsourced platforms like Estimize or Kaggle offer collective intelligence for trading strategies. These insights often outperform traditional estimates by tapping into the wisdom of diverse participants.

For instance, crowdsourced earnings predictions can give hedge funds an edge over Wall Street consensus estimates.

Challenges of Integrating Alternative Data

The journey of transforming raw alternative data into actionable insights for trading strategies.

Data Privacy and Regulation

Using alternative data comes with a maze of compliance requirements. Regulators like the SEC and GDPR enforce strict rules on:

- Personal data usage, such as geolocation tracking.

- Transparency in how data is sourced and applied.

- Avoiding insider trading risks tied to proprietary datasets.

Navigating these regulations requires traders to prioritize ethical data practices, ensuring strategies are both effective and compliant.

Cost of Acquisition and Analysis

The costs associated with alternative data can be prohibitively high, especially for smaller firms. These include:

- Subscriptions to premium data sources.

- Infrastructure for storing and processing large datasets.

- Hiring experts skilled in data science and machine learning.

Despite these hurdles, the value-added insights from alternative data often outweigh the initial investment.

Ethical Implications of Using Alternative Data

The Fine Line Between Innovation and Intrusion

Alternative data’s immense potential raises ethical questions about how it’s collected and used. For example:

- Geolocation tracking might provide valuable insights but can infringe on personal privacy.

- Web scraping can lead to intellectual property concerns if platforms’ terms of service are violated.

Balancing innovation with responsible data use is vital. Traders need to ensure their strategies adhere to legal frameworks and public expectations.

Transparency and Accountability

Transparency in data sourcing and algorithms is critical for building trust. Firms using alternative data should:

- Disclose their data sources to clients or investors.

- Implement checks to prevent biases in machine learning models.

- Follow industry standards like the Global Data Ethics Project for guidance.

Without these measures, traders risk reputational damage and regulatory scrutiny.

Success Stories of Alternative Data in Trading

Hedge Funds Leading the Way

Top hedge funds have harnessed alternative data to outperform traditional strategies. Examples include:

- Using satellite imagery to predict Walmart’s quarterly performance, enabling accurate stock bets.

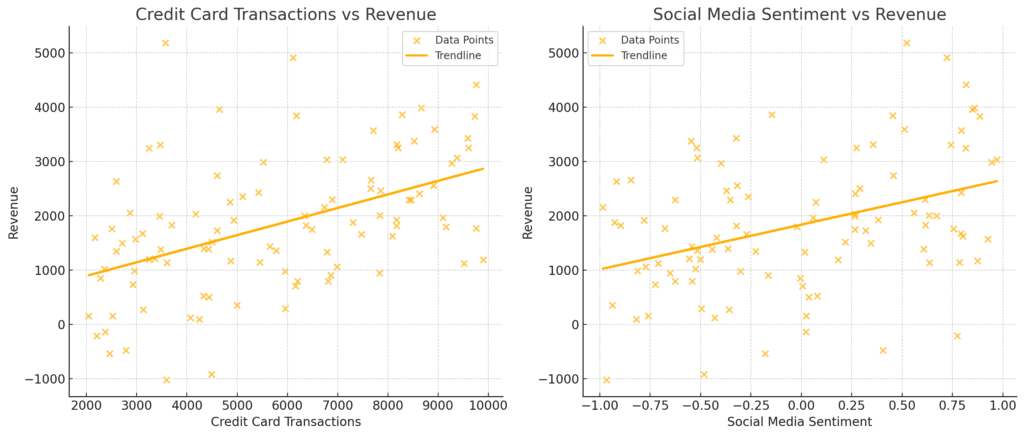

- Tracking credit card transactions to estimate consumer spending trends.

These cases highlight the advantages of real-time, granular data in shaping high-performing trading models.

Retail Investors Joining the Revolution

With platforms offering access to alternative datasets, retail investors now participate in this trend. Tools like Robinhood Snacks or Sentimentrader provide simplified insights into:

- Social media trends.

- Emerging market sectors.

This democratization levels the playing field, making alternative data accessible to more participants.

The Future of Alternative Data in Trading

Advances in AI and Big Data

The intersection of artificial intelligence and big data will further enhance the utility of alternative datasets. Future developments may include:

- Enhanced predictive models that combine multiple alternative data streams.

- Real-time dashboards powered by AI, offering traders instant actionable insights.

As AI technology evolves, expect a seamless integration of diverse data sources into trading systems.

Regulatory Developments

Governments and regulatory bodies will likely increase their oversight as alternative data becomes more prevalent. Key areas of focus might include:

- Standardizing data usage policies across industries.

- Introducing data fairness requirements to prevent market manipulation.

- Balancing innovation with protecting consumer privacy rights.

Staying ahead of these developments will be essential for firms that rely on alternative data strategies.

Building Resilient Trading Strategies with Alternative Data

Diversification Through Data

Incorporating multiple alternative data sources helps traders reduce risk and maximize potential gains. Examples include combining:

- Weather data for agricultural predictions.

- Social sentiment for consumer-focused stocks.

- Supply chain data to monitor industrial health.

This approach ensures that no single dataset dominates decision-making, providing well-rounded strategies.

Continuous Learning and Adaptation

Markets evolve, and so do data trends. Traders must continuously adapt their algorithms by:

- Testing new datasets regularly.

- Refining machine learning models to address changing market conditions.

- Investing in research to stay ahead of emerging data sources like IoT signals or blockchain analytics.

With this mindset, traders can maintain a competitive edge in the rapidly advancing field of algorithmic trading.

Conclusion

The rise of alternative data has reshaped the landscape of algorithmic trading, offering traders a wealth of untapped opportunities. From satellite imagery to social media sentiment, these unconventional datasets provide actionable insights that can redefine success.

As the field evolves, balancing innovation with ethics and cost with compliance will be critical. With the right strategies, alternative data will continue to play a pivotal role in the future of trading.

FAQs

What role does AI play in alternative data analysis?

AI simplifies the processing of vast alternative datasets by:

- Cleaning noisy data for better accuracy.

- Identifying predictive patterns using machine learning models.

- Automating real-time decision-making.

For example, an AI algorithm could monitor social media for a spike in mentions of a company and initiate trades based on predicted price movements.

Is alternative data more effective than traditional data?

Alternative data doesn’t replace traditional data but complements it. For example, earnings reports provide foundational metrics, while alternative data (like social sentiment or website traffic) offers real-time context. Together, they create a more comprehensive picture of market dynamics, enhancing the effectiveness of trading strategies.

How can traders ethically source alternative data?

Traders must follow legal and ethical guidelines, such as:

- Purchasing data from verified providers.

- Ensuring compliance with privacy laws, such as GDPR and CCPA.

- Avoiding questionable practices, like scraping private platforms without permission.

For instance, using anonymized mobile geolocation data from a licensed vendor ensures both legality and ethical integrity.

How quickly can alternative data impact trading decisions?

Alternative data often provides real-time insights, allowing traders to act faster than competitors relying on traditional datasets. For example, a spike in social media mentions about a company can signal an impending price movement, enabling traders to respond within minutes.

Similarly, geolocation data can reveal trends in retail activity weeks before official sales numbers are released, giving traders a significant head start.

What is the role of ethics in using social sentiment data?

Ethics in social sentiment analysis revolves around transparency and consent. For instance:

- Traders should only use data from public forums or social platforms where users knowingly share their opinions.

- Tools analyzing social sentiment must ensure non-invasive practices, avoiding personal profiling.

For example, analyzing trending hashtags is ethical, but extracting private user data or monitoring direct messages isn’t.

Can alternative data help predict market crashes?

Yes, alternative data can offer early warning signals of market instability. Examples include:

- Tracking news sentiment during geopolitical crises.

- Monitoring supply chain disruptions through shipping or production data.

- Detecting unusual trading activity or social chatter around specific sectors.

For example, during the 2020 pandemic, geolocation data revealed a drop in travel and retail activity, predicting economic slowdowns before official data confirmed it.

How does web scraping contribute to trading strategies?

Web scraping gathers public data from online sources like e-commerce platforms, job boards, or forums. Traders use this data to identify trends such as:

- Rising demand for specific products, observed through price or availability changes.

- Corporate hiring patterns, signaling business expansion or contraction.

For instance, analyzing job postings from a tech company might indicate upcoming product launches or development initiatives, influencing investment decisions.

Are there risks to relying heavily on alternative data?

Yes, risks include:

- Overfitting models: Using too much data can make algorithms overly complex and less adaptable.

- Data biases: Certain datasets may favor specific sectors or companies, skewing insights.

- Legal pitfalls: Misusing data from unauthorized sources can lead to fines or litigation.

For example, an overreliance on web-scraped consumer sentiment might backfire if the sample excludes key demographics, leading to inaccurate predictions.

How do hedge funds keep their alternative data edge?

Hedge funds invest in:

- Proprietary data sources, such as custom satellite feeds or exclusive partnerships with providers.

- Advanced AI models to process and analyze alternative data efficiently.

- Continuous innovation, testing new datasets like IoT signals or blockchain analytics.

For example, a hedge fund might integrate drone surveillance data to assess warehouse activity for logistics companies, giving them unique insights unavailable to most competitors.

Can alternative data predict earnings reports?

Yes, traders often use alternative data to forecast earnings outcomes before official reports. Examples include:

- Credit card transaction data to estimate retail sales revenue.

- Social sentiment analysis to gauge consumer excitement for new products.

For example, a spike in restaurant foot traffic before earnings season might signal higher-than-expected revenues for a dining chain, enabling traders to act ahead of the market.

What is the future of alternative data in trading?

The future of alternative data lies in integrating emerging technologies like:

- IoT data: Real-time insights from connected devices, such as industrial sensors or smart city infrastructure.

- Blockchain analytics: Tracking cryptocurrency movements and decentralized finance activities.

- AI-driven predictive models: Combining multiple alternative datasets for enhanced market forecasting.

For instance, smart agriculture sensors might offer real-time updates on crop conditions, enabling traders to predict commodity prices with unprecedented accuracy.

Resources

Tools and Platforms for Alternative Data

- Quandl: A leading platform for accessing structured alternative datasets, including economic, ESG, and market data.

Visit Quandl - Sentieo: Combines financial data with alternative data and natural language processing for insightful analyses.

Visit Sentieo - Thinknum: Focuses on tracking company performance through web-scraped insights like hiring trends or social media mentions.

Visit Thinknum - Kaggle: Offers datasets for experimentation and collaboration, allowing users to test alternative data strategies.

Visit Kaggle

Educational Resources

- Books:

- “Alternative Data in Asset Management” by Alexander Denev and Saeed Amen: An in-depth guide to integrating alternative data into trading strategies.

- “Big Data and Machine Learning in Quantitative Investment” by Tony Guida: Explores the role of machine learning in leveraging big data for financial markets.

- Online Courses:

- Coursera – Financial Data Analysis and Algorithmic Trading: A comprehensive course covering traditional and alternative datasets.

- Udemy – Machine Learning for Trading: Learn to apply machine learning techniques to analyze alternative data sources.

Industry Blogs and Reports

- NASDAQ’s Alternative Data Blog: Offers insights into how alternative data shapes markets.

- JP Morgan Insights: Regular reports on innovations in trading, including the role of alternative data.

- The Alternative Data Blog by Exabel: Features deep dives into tools and strategies for incorporating alternative data into investment processes.

Alternative Data Providers

- RS Metrics: Specializes in satellite imagery for monitoring environmental and industrial trends.

Visit RS Metrics - Orbital Insight: Offers geospatial data for predicting market trends.

Visit Orbital Insight - AlphaSense: Delivers real-time insights by combining alternative data with AI-powered search technology.

Visit AlphaSense

Communities and Forums

- Alternative Data Weekly Newsletter: Stay updated on new trends and tools in the alternative data space.

Subscribe Here - r/AlgorithmicTrading on Reddit: A forum for discussing trading strategies, including those leveraging alternative data.

Join the Community - FinTwit: The financial Twitter community shares real-time insights into market trends and data-driven strategies.

Conferences and Events

- The Alternative Data Summit: A premier event for learning about cutting-edge applications of alternative data in trading.

Event Details - BattleFin Discovery Day: Connects data providers with traders and firms looking to integrate new datasets.

Visit BattleFin

These resources provide the tools, insights, and networks needed to master alternative data in algorithmic trading.